Lottery Taxes Guide: What Every Winner Needs to Know

- Snappy introduction to why understanding taxes is crucial for lottery winners—big or small.

- Main keyword: lottery taxes guide.

- Set the tone: direct, jargon-free, and focused on real-world outcomes.

Lottery Taxes Guide: What Every Winner Needs to Know

A lottery win feels like lightning in a bottle—a rush, a sea of zeros, and a wide-open future. But before you dive headfirst into big dreams, remember this: with every jackpot comes a rendezvous with taxes. Ignore the taxman, and your celebration might turn sour fast. That’s where this lottery taxes guide comes in.

Whether you’ve scored a local scratch-off or hit the Powerball megaprize, understanding how taxes work isn’t just smart—it’s survival. Don’t let jargon or confusion trip you up. Here, we cut straight to the bottom line: what you owe, when you owe it, and how to keep your winnings working for you, not draining away in surprise bills. Think of this as your reality check and roadmap rolled into one. Welcome to the real world of winning—and keeping—your prize.

The Basics: Tax Implications When You Win

Let’s cut straight to it: if you win the lottery, the IRS considers your prize “ordinary income.” That means your ticket to sudden wealth also comes with a ticket to tax Day reality. There’s no special free pass—lottery jackpots are taxed just like a bonus at work, a freelance check, or casino winnings.

Federal vs. State Taxes

Uncle Sam always comes first. For any win above $5,000, the lottery operator withholds 24% of your payout for federal taxes right off the top. Don’t celebrate too soon, though—that’s just a starting point. Most big wins push you into a higher tax bracket, so you could owe more when you file your return.

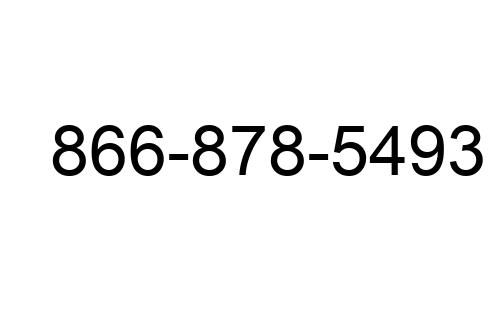

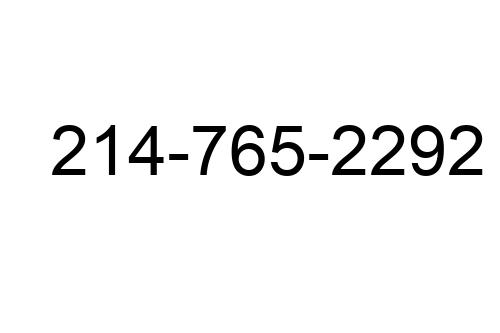

On top of that, many states take a cut, too. Live in New York? They’ll hit you with over 10% on your winnings. Some states, like Florida or Texas, take nothing. Others land somewhere in the middle, and a few cities (hello, New York City) want a slice as well. Pro tip: check your local and state rates before you even pick up your check.

Lump Sum vs. Annuity

Now for the big decision: lump sum or annuity. Take the lump sum, and you get all your winnings at once—but you’re taxed on the entire amount that year. Opt for the annuity, and you get payments spread out over 20-30 years. Each payment is taxed as you receive it, possibly keeping you in a lower tax bracket year-to-year.

Bottom line: your choice impacts how and when you pay taxes, and—sometimes—the total amount. Pick wisely, and always run the math before signing anything. That’s the first rule for any winner’s financial obligations.

Your Winners’ Financial Obligations, Explained

Winning is the fun part. Paying taxes is not. But if you want to hold onto that prize, understanding what you owe—and when—is non-negotiable.

First, the IRS doesn’t mess around. When you win big ($5,000 or more), the lottery automatically withholds 24% off the top for federal taxes. Think of it as a first down payment, not the final bill. If you end up in a higher tax bracket because of your win, you could owe more at tax time. Your state may also want a chunk—rates vary, sometimes a little, sometimes a lot, and a few states skip this bite completely.

So, what’s immediate withholding? That’s the cash skimmed before your check hits your hand. But come April, what you actually owe is based on your total income—your day job plus your flashy windfall. For many winners, that means the first withholding won’t cover the full amount. You’ll need to prep for a possibly hefty remaining bill. Even more reason to avoid blowing it all at once.

The trick to staying ahead: estimated tax payments. If your lottery pay-out rockets you into a higher bracket (say, jumping from $50k annual income to $2 million), the tax man expects you to cough up quarterly. Miss this? Hello, underpayment penalties. Avoid those with a simple move—use the IRS’s online calculator or chat with a tax pro. Pay what you’ll owe before the deadline.

A quick example: Score $100,000? The lottery withholds $24,000 federal right away. State wants 5%? That’s $5,000 more. But if your total income puts you at a 32% federal tax rate, your actual federal tax is $32,000—so come April, you’ll owe another $8,000. Win $1 million? Same math, just more zeros. If you’re only prepared for what was withheld, that’s a bad surprise.

Bottom line: Withholdings are the beginning, not the end. Know what you’ll actually owe. Pay estimates if you need to. Don’t let non-payment penalties eat into your win. You handle this part, the rest of your prize is yours to enjoy.

What Happens After Winning Millions?

Winning a life-changing lottery jackpot is every player’s dream, but few are prepared for what comes next. The sudden influx of wealth can bring excitement and a wave of challenges. Managing taxes and investments becomes crucial, as reckless spending can drain fortunes unexpectedly.

The Financial Reality of Winning

Many winners face critical financial decisions almost immediately:

- Taxes and Legal Obligations: A large portion of the winnings often goes to taxes, and lacking a plan can lead to legal troubles.

- Investing vs. Spending: Some winners hire financial advisors for long-term security, while others spend impulsively without a plan.

- Budgeting for the Future: Without proper money management, even the biggest jackpots can quickly disappear.

A Lifestyle Overhaul

A sudden fortune changes life in various ways:

- Luxury Purchases: Mansions, sports cars, and extravagant vacations become instantly affordable.

- Social Pressure: Long-lost friends and distant relatives may reappear, expecting a share of the winnings.

- Privacy Challenges: Some winners struggle with unwanted media attention and public scrutiny.

While some winners embrace their wealth openly, others choose to live discreetly to avoid pressure and expectations.

Giving Back and Creating a Legacy

For some, wealth is not just about personal luxury—it’s an opportunity to make a difference. Many winners choose to:

- Donate to charities and community projects.

- Fund scholarships or support education initiatives.

- Invest in businesses that create jobs and opportunities.

Some lottery winners go from players to philanthropists, proving that wealth can be used for a lasting impact. However, not all stories end positively—many who fail to manage their winnings properly find themselves bankrupt within years.

Pitfalls to Avoid: Common Missteps After a Win

Let’s not sugar-coat it—plenty of winners wind up with way less than expected because they overlook a few critical details. First, don’t forget about local taxes. Even after the federal and state take their bite, your city or county can swoop in for a piece. Miss that detail and you could be writing a surprise check when taxes are due.

Next: your tax bracket. Scoring a jackpot—even a “small” one—can launch you into a much higher bracket than you’re used to. That means a bigger portion of your winnings will get taxed at these higher rates. Many people misjudge this and set aside too little, leaving a nasty surprise come April.

Finally, splitting a prize is trickier than you think. If you win with a group—family, friends, coworkers—taxes don’t just sort themselves out. If the lottery pays one person who then distributes it, that person may get stuck with all the tax burden and have to prove the money was shared. Handle splits directly through the lottery whenever possible or have airtight paperwork.

Bottom line: Don’t get caught off guard. Extra taxes and paperwork can eat into your good fortune faster than you expect. Stay sharp, ask questions, and plan for every cut—no regrets, just rewards.

Level Up: Plan Like a Pro

After you’ve wrapped your head around the basics, it’s time to get strategic. This isn’t just about paying what you owe—it’s about protecting your windfall for the long haul. If your lottery win is serious money (and even if it’s “just” thousands), consider setting up a trust. Trust structures can shield your identity, help you manage your winnings, and give you more privacy than claiming as an individual.

This is where specialists come in. Look for a financial advisor who actually gets lottery winnings—bonus points if they’ve worked with big winners before. Tax pros and estate planning attorneys can also plug blind spots you might not see coming, like inheritance taxes or the best way to pass on your money.

Basically: don’t try to wing this solo. Even a single session with the right advisor can save you from rookie mistakes or IRS headaches. Want more smart moves? Check out this essential beginner’s guide for making your jackpot last. Your future self will thank you.

Additional Resources for Smart Winners

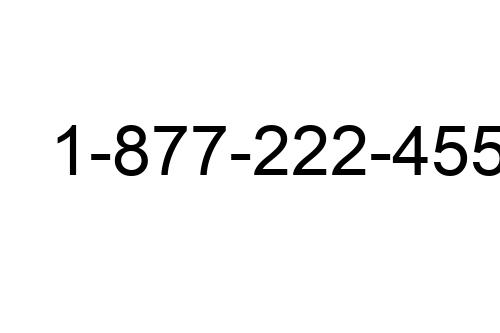

Feeling overwhelmed? That’s normal—lottery taxes aren’t exactly light reading, but missing something could cost you. If you want to dig deeper, skip the rumor mill and go right to the source: the IRS Lottery and Gambling Winnings page breaks down exactly what forms you need and how to report your prize. Most state revenue department websites have their own lottery tax info pages too—worth a quick search so you know your local rules.

Looking for plain language advice or want to see more real-world examples? LotteryTaxes.com is a solid starting point. The site covers state-by-state breakdowns, smart filing moves, and practical strategies to keep more of your win.

If you’re thinking big (six-figure win or more), a check-in with a tax professional isn’t overkill—think of it as buying expert insurance for your sudden wealth. Remember: a few minutes of research and prep now can save you a tax headache (or audit letter) down the line.

Wrap-Up: Winning Wisely

Winning the lottery is life-changing, but what you do next matters just as much as the numbers on that check. Here’s the bottom line: understand exactly what you owe, keep records tight, and don’t let taxes take you by surprise. Whether your jackpot is the stuff of headlines or just a nice bonus, staying informed about your obligations will protect your windfall and your peace of mind. So, congratulations—enjoy every dollar. Just remember to play (and win) smart: document, plan ahead, and never hesitate to get help if you need it. Your future self will thank you.

George Dreyer brought valuable knowledge and creativity to the development of Jackpot Rush Empire, playing a key role in shaping the platform’s vision alongside its founder. With his keen eye for detail and dedication to quality, he helped ensure that the site delivers engaging lottery insights and meaningful content for its audience. His contributions were essential in building a platform that not only informs players about results and jackpots but also emphasizes responsible gaming and safe participation, aligning closely with the mission of Jackpot Rush Empire.

George Dreyer brought valuable knowledge and creativity to the development of Jackpot Rush Empire, playing a key role in shaping the platform’s vision alongside its founder. With his keen eye for detail and dedication to quality, he helped ensure that the site delivers engaging lottery insights and meaningful content for its audience. His contributions were essential in building a platform that not only informs players about results and jackpots but also emphasizes responsible gaming and safe participation, aligning closely with the mission of Jackpot Rush Empire.